#Energy

Hydrofracturing Without the Hydro

Hydrofracturing needs water – lots of water. The typical North Dakota well requires 3–5 million gallons of water, and it must be reasonably clean

Recycling fracturing fluids is big business, but ridding water of dissolved solids is expensive and generates a waste stream of its own. Brackish water is often found in the salt-laden formations bordering gas reservoirs, and can be used for some wells.

An ongoing problem, however, is the growing competition for water sources. Agriculture and energy producers are already competing with domestic users for water supplies across North America, and the situation is only expected to get worse.

Oil and gas producers often are last on the list of preferred water customers. When it comes to feeding people or drilling wells, people usually win. Faced with restrictions on water usage, drillers are looking for ways to reduce or eliminate water as a fluid in their hydraulic fracturing processes.

Many alternatives are either under development or in commercial use. These include “energizing” water with supercritical gases, using liquefied gas as the primary fracturing fluid and converting propane into a liquid for use as a fracturing fluid. Each has its benefits and drawbacks, but all are currently either in trials or commercial use somewhere in the U.S.

Freeing Tight Oil and Gas

Hydrofracturing is a technique used to free up “tight” oil and gas. The process begins with a drilled well, which often branches out into multiple horizontal bores extending across a resource-producing geologic formation. Once the wells are drilled, a mixture of water, stabilizers and “proppants” – particles designed to keep fractures open and flowing - is pumped into the well at high pressure. The fluid then is removed and the well cleaned of excess proppant and fractured particles with the use of more fluids. After cleanout, the well is brought online. Some wells are self-pressurizing, while others require mechanical pumping to extract the hydrocarbons.

Traditional fracturing fluid is 99% water. Adding a small percentage of liquid nitrogen or carbon dioxide to the water is possible due to the pressures involved. This process, called “energized fluid,”has several advantages. Most importantly, it improves the effectiveness of the fracturing fluid, thus reducing the amount of water needed. Cavitation and bubbles from the entrained gas improve proppant insertion, leaving less excess proppant to be cleaned from the completed well.

“There is no question that there is not as much application of this technology as there could be,” says Mukul Sharma, a professor at the University of Texas, who has been researching energized fractures. “We have seen a clear benefit in many of the Canadian shales using these energized fluids.”In the U.S., however, it appears to be a chicken-and-egg issue with suppliers willing to supply the gas, but needing a constant market demand to justify building gas plants.

Energizing the water reduces the swelling of clay particles in the formation, thereby improving final porosity and hydrocarbon flow. Energized fluids require fewer additives like acids, viscosity controls and swelling retardants, reducing environmental risks. If water is available and an established treatment program is in place, gas energizing may be the best solution.

Cryogenic Fracturing

But what if a site has access to an inexpensive, high-volume source of carbon dioxide? Producing fields that are near an electric power plant and that is capturing carbon dioxide (CO2) may mean that using liquefied CO2 as a means of fracturing is a great choice. Known as cryogenic fracturing, the use of liquefied CO2 or nitrogen may soon become a water-alternative in water-stressed parts of Texas, Colorado and California.

The Colorado School of Mines in Golden, Colo., has several cryogenic test wells under development. Researchers there are starting cryogenic fracturing fluid injection tests. To date the report having tested only liquid nitrogen. This fluid is easily obtainable, boils rapidly, cools rock quickly and is nontoxic, the researchers say. Liquid nitrogen at a temperature of -321F fractures the rock by pressure and also with thermal shock. Because no water is used, clays don’t swell and there is little pollutant-laden flowback fluid to deal with.

The main problem with cryogenic fracturing is getting gas to the well. Although CO2 pipeline construction is expanding across North America, few areas are well served.

The U.S. has more than 500,000 miles of gas pipelines, and roughly 3,600 miles of CO2 pipelines. Existing CO2 pipelines, originally built to support enhanced oil recovery, connect suppliers to fields in west Texas, southern Colorado, Louisiana and Mississippi, and northern North Dakota. Neither California nor the Northeast have CO2 pipeline networks, limiting those areas to bottled gas or nothing. Several industrial gas producers are promoting stand-alone extraction systems, primarily for nitrogen, but the cost so far remains prohibitive.

Another challenge with liquefied gas is getting even distribution of proppants in rock formations. Several producers are working with gelled CO2 in sandstone, where the need for proppants is less and the fluid is capable of carrying its own proppant load. Thermal fracturing is also a problem in some formations, as it tends to over-fracture the wellbore lining and may cause enough clogging that the net thermal benefit falls to zero. Pumps, seals and operating procedures all will need an upgrade to deal with these low operating temperatures.

On the plus side, liquid CO2 combines with entrained water to form carbonic acid, which further erodes fissure linings and improves porosity. As the liquid CO2 turns back to a gas inside the formation, that entrained energy can be used to clean out the formation and prepare it for production. If a cheap, abundant and reliable source of CO2 is available to drillers, access to water may become a moot point.

Hydrocarbon-based Techniques

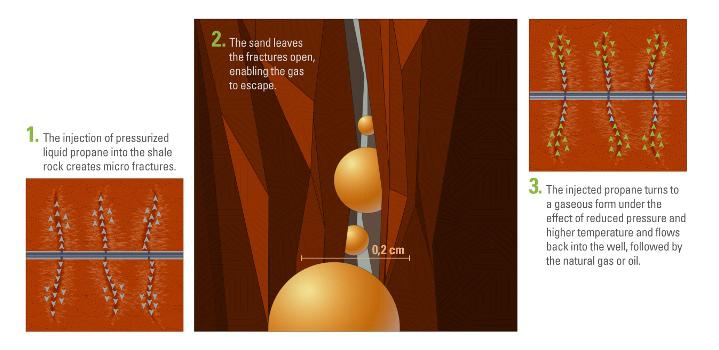

Hydrocarbon-based fracture fluids offer a third alternative. Two things natural gas fields have in abundance are natural gas and propane. First tested in 2007, propane-based fracturing is currently under commercialization by several companies, including Calgary, Alberta-based GasFrac and Houston-based ecorpStim. The chief benefits of propane-based fracturing are access to supply and simplified cleanup. The downside is the high level of care needed to prevent fires and explosions.

ecoStimPropane-based fracturing has historically relied on liquefied propane, but butane and pentane are allowable in smaller amounts for certain rock types. All three combine well with the produced gas stream and dissolve equally well in oil and other gas liquids, converting the fracturing fluid to end-product.

Propane’s flammability is an issue. Richard Spears, a leading oilfield services adviser to the petroleum industry and a former Halliburton engineer, was reported as saying, “As a former frack engineer, I get the willies when I think about getting anywhere near a frack that is flammable. When it catches fire, it doesn’t burn nicely.”

EcorpStim responded to this challenge with a non-flammable solution called heptafluoropropane. According to the company, the fluid is non-flammable, non-toxic and its high specific gravity delivers proppant loads effectively and completely. On the down side, it’s not a natural byproduct of gas wells, needs to be purchased from a supplier and requires separation from the produced gas stream after use. GasFrac, by contrast, promotes the use of pure propane.

Ongoing Quest

As the need to conserve potable water expands, finding other fluid options for hydrofracturing becomes an increasingly important consideration for oil and gas producers. In areas where CO2 pipelines exist and water is expensive, cryogenic fracturing may be the favored option option. On the other hand, the benefits of energized fluid technology may be so compelling that the cost of sourcing liquefied CO2 or nitrogen may not matter. Finally, in regions where neither water nor pipelines exist, propane-based fracturing is worth examination, although the process is still in its infancy.

One fact remains: conflicts over water are likely here to stay. Finding viable options increasingly is a priority for the oil and gas industry.